Developing a Framework for Real-Time Trading in a Laboratory Financial Market

This project deals with high-frequency trading and economic engineering means to prevent arbitrage profits in the financial market. These quasi-risk-free profits are only accessible to so-called high-frequency traders (HFTs), such as BlackRock and Vanguard. HFTs are market participants typically characterized by algorithmic trading at the speed of light without any intrinsic interest to own or owe an asset. The basic idea is that simultaneously available information that affects stock prices - think of a tweet from Elon Musk or Donald Trump - might be exploited by those who react first. This raises concerns in both academia and public policy.

Although Economic engineering offers approaches to eliminate these arbitrage opportunities, regulators face the difficult task of identifying appropriate market interventions without having landmark data. Data is impossible to collect since it is more than unlikely that financial markets around the world will change their rules for a day just for the sake of experimentation. But indeed, this would be necessary, as the solution approaches only realize their full potential if there is a world-wide rollout. Therefore, we are testing several of the market design solution in an artificial financial market in a laboratory. This artificial market enables real-time algorithmic trading at millisecond speeds, providing a more accurate laboratory replication of the financial market mechanisms relevant to high-frequency trading than has been achieved up to this point. However, this project discussed the difficulties of developing difficult a sufficiently sophisticated software, and moreover, it is far from trivial to adequately communicate the complex financial market rules to our non-expert lab subjects. To overcome these challenges, this project discusses bottlenecks arising from the underlying software and the laboratory infrastructure, plus it analyzes data from pilot sessions.

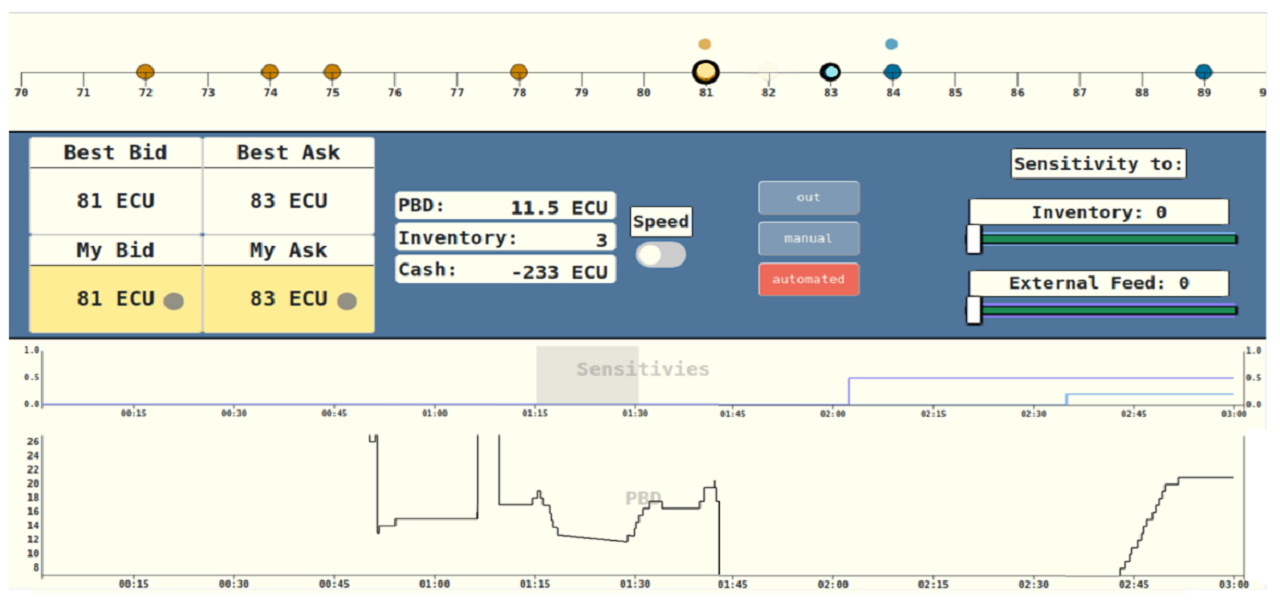

The image on the left shows the trading platform available to subjects during each trading period. Subjects

a given the choice to take on the role of HFTS by turning on a trading bot, which will trade on their behalf.

The underlying artificial exchange ensures serial processing of messages, an important part of the real-world financial

market, but a difficult function to implement in the lab given modern multi-core processors.

The image on the left shows the trading platform available to subjects during each trading period. Subjects

a given the choice to take on the role of HFTS by turning on a trading bot, which will trade on their behalf.

The underlying artificial exchange ensures serial processing of messages, an important part of the real-world financial

market, but a difficult function to implement in the lab given modern multi-core processors.

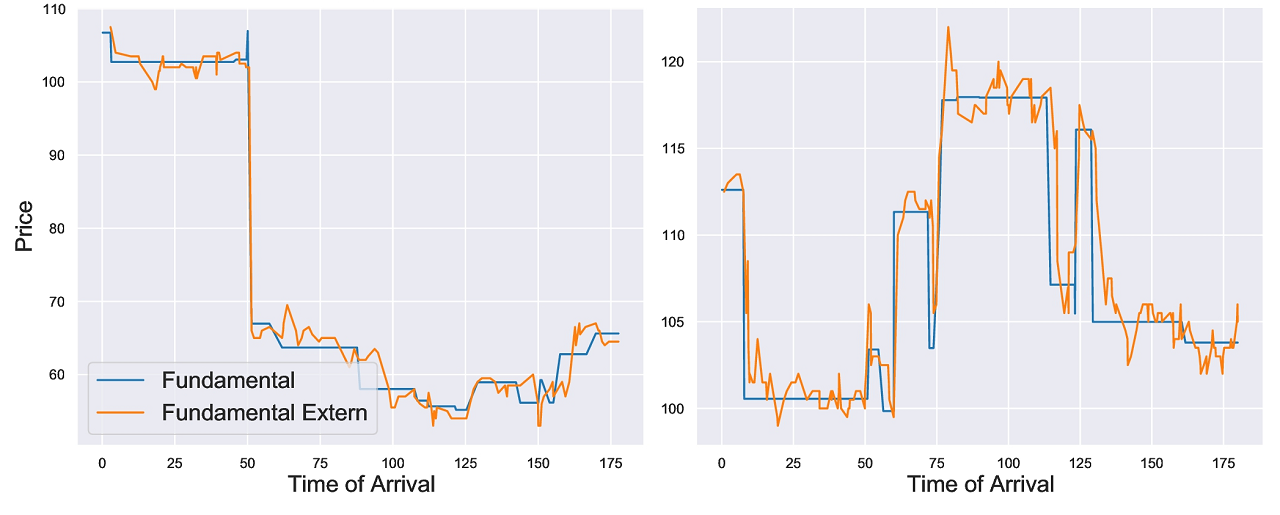

Another major advantage of the laboratory study, apart from world-wide roll-out, is the full control over price

movements. This allows us to study the behavior of HFTs under both normal and stressful market conditions. Stressful

market conditions can take different forms, for example, the left side of this figure shows a sudden and significant

market collapse, while the right side shows a very volatile market. In fact, even a boom phase, such as the recent

GameStop (GME) frenzy in early 2021, may be considered stressful for HFTs.

Another major advantage of the laboratory study, apart from world-wide roll-out, is the full control over price

movements. This allows us to study the behavior of HFTs under both normal and stressful market conditions. Stressful

market conditions can take different forms, for example, the left side of this figure shows a sudden and significant

market collapse, while the right side shows a very volatile market. In fact, even a boom phase, such as the recent

GameStop (GME) frenzy in early 2021, may be considered stressful for HFTs.

If you are interested in more particulars and technical details, please feel free to check out my Working Paper now available online. If you are more interested in the data analysis of the pilots and the lessons learned, please checkout GitHub.